Anti-Dismal

A blog on all things to do with economics and related subjects

Monday, 29 December 2025

Coase versus Becker on utility maximisation

Monday, 9 June 2025

A history of the contemporary mainstream economic theory of the firm 1920 - 2020. A story of opportunities taken and missed.

We will examine the opportunities that were taken and those that were missed in the development of the mainstream economic theory of the firm over the period from 1920 to 2020. The 1920s were the earliest time when ideas that came to form part of the contemporary mainstream economic theories of the firm were put forward. The main ideas and people that have shaped – or, in several cases, not shaped - the history of the theory of the firm will be examined so that we can see how the theories have changed through time and how we got the theories we see today.

A history of the contemporary mainstream economic theory of the firm 1920 - 2020. A story of opportunities ... by Paul Walker

Wednesday, 12 June 2024

100 years of the theory of the firm. Or may be only 50.

Depending on how you pick your starting point there has been, roughly, 50 or 100 years of the mainstream economic theory of the firm.

In support of the 100 years view it has been argued that the mainstream approaches to the firm began in 1921. This (minority) view is succinctly expressed by Harold Demsetz

“[ … ] it can be said without hesitation that Knight launched the modern theory of the firm in 1921” (Demsetz 1988: 244).

The more commonly accepted 50-year position is that the theory of the firm did not begin until the 1970s, with the advent of the Coaseian-based approaches to the firm.

But even if the earlier starting date is accepted, it must be said that the period 1920 to 1970 is something of a ‘dark age’ for the theory of the firm. It is largely one of missed opportunities with just two works contributing to the way mainstream economists think about the firm today. Knight (1921) and Coase (1937) can be seen as ‘precursors’ to the modern theories of the firm while the theories developed from these precursors represent the ‘opportunities taken’. The ‘opportunities taken’, including the transaction cost approach, the principal agent approach, the incomplete contracts approach and the reference point approach, all of which started to develop post-1970.

Those works which apply the division of labour to the theory of the firm (more correctly, to the theory of firm-level production) as well as the partial models of the firm arising from the ‘rationalisation’ debate along with Plant (1937) and Malmgren (1961) are part of the ‘opportunities missed’ from the 1920 to 1970 period.

Despite the division of labour being a very old idea in economics, dating from at least the ancient Indians, Greeks and Chinese, it took more than two thousand years for it to give rise to a theory of production, but it has not generated a genuine theory of the firm. Following on from the ancient scholars, in the medieval period both Islamic and Christian theologians and philosophers analysed the concept, and consequences, of the division of labour. The pre-classical, classical and neoclassical economists continued and expanded the enquiry, but all without applying the division of labour to the theory of the producer or the firm. One possible exception to this rule is Adam Smith. Zouboulakis (2015) argues that Smith’s discussion of the division of labour does offer an elementary explanation for the existence of firms. In Zouboulakis’s view of Smith the existence of firms is explained through division of labour dynamics. As the market grows more firms are created and they become larger thereby employing more labour and capital and thus there is an increase in specialisation and the division of labour. This in turn increases efficiency and productivity which increases general economic wellbeing.

It was not until the 20th century that a division of labour-based theory of production finally appeared. In the 1920s Lawrence Frank saw an increasing division of labour as giving rise to the vertically integrated producer. In the 1930s E. A. G. Robinson argued that the division of labour affected the size of the producer due to its effects on production technology and management. By the 1950s George Stigler was arguing that the size of the producer was limited by the division of labour due to the division of labour being limited by the extent of the market. In the 1990s Gary Becker and Kevin Murphy saw the size of the producer as being limited not just by the size of the market but also, more often, by coordination costs. In 2018 Michael Rauh showed that the division of labour, which translates to the size of the producer, can be, depending on circumstances, limited by the extent of the labour market, moral hazard or an ‘O-ring’ property. In this paper Rauh utilises a stochastic or ‘O-ring’ production function. Importantly with an O-ring production function, if one part of the production process fails, the whole process fails.

But despite this, belated, interest in the division of labour, within the contemporary mainstream economics literature the division of labour is still very much a minority approach to the analysis of production and has had no impact on the mainstream theory of the firm.

Concerning ‘rationalisation’ Cristiano (2015: 601) explains,

"[i]t was associated with the idea that it was possible to reduce average costs per unit of output by means of larger firms without necessarily incurring the problem of monopoly power—an idea that enjoyed wide circulation in the British press at that time. Henry Clay (1929, p. 171) wrote that rationalization “implies industrial combination with the object of securing not monopoly prices, but certain productive economies". Writing about the situation in Lancashire in 1926, John Maynard Keynes sympathized with ``what the Germans are calling `rationalisation', that is, the concentration of demand on the most efficient plants, which are worked at full stretch and the rest closed down" (1971–89, XIX, p. 579; hereinafter CWK ); "a `rationalising' process designed to cut down overhead costs by the amalgamation, grouping or elimination of mills'' ( CWK, XIX, p. 584)".

During the rationalisation debate, Lavington (1927) and Robinson (1931) argued that the size of the firm is determined by a trade-off between increasing returns to scale and decreasing returns to management. However, these are only partial models of the firm because there is no recognition of the need for transaction costs in the models.

Plant (1937) made a notable, and most surely underrated, contribution to the theory of the firm. The paper is usual for its time in that it made a notable contribution to the theory of organisations before the 1970s renaissance of the theory of the firm. Plant’s ‘Centralize or Decentralize?’ furnished detail and content for several aspects of Coase’s arguments where those facets were left underdeveloped by Coase.

It is a contribution in which, for example, the “[ . . . ] discussion provides more empirical content than Coase regarding the costs of using the price system and the results on firm size [ . . . ]” (Boudreaux and Holcombe 1989: 149). In Robert Hébert and Albert Link’s view, Plant develops a transaction cost approach to the firm independently of Coase.

“A “transaction costs” approach to the firm was pioneered independently by Plant (1937), who attempted to explain why firms become centralized or decentralized” (Hébert and Link 2006: 383).

Carlo Cristiano also sees transaction cost arguments in Plant’s work,

“[t]he concept of a cost in using the market, along with the idea that business size depends on the balance between this cost and coordination costs, is implicit but nonetheless rather clear in Plant’s argumentation” (Cristiano 2015: 610).

All this is no mean feat.

And yet today we see no ‘Plantian’ research agenda. Plant’s work has been ignored in the history of the theory of the firm.

Malmgren (1961) provided the first amplification of Coase’s analysis in his ‘The Nature of the Firm’ paper.

Malmgren’s primary sources of insight came from the works of Coase, Hayek, Richardson and Penrose. Lise Arena argues that

“[h]is contributions favoured a multi-disciplinary approach, incorporating ideas not only from economics, but also from organisational theory, game theory and information theory” (Arena 2021: 88).

Klaes (2000) argues that Malmgren was the first person to associate Coase’s analysis with the idea of transaction costs.

“Malmgren (1961) was also the first to link Coase (1937) with the notion of transaction costs. It appears that Malmgren broadly adopted Coase’s general strategy of analysing the nature of the firm. However, while Coase focused predominantly on the costs of organizing transactions across the market, while following closely the reasoning of Kaldor (1934) and Robinson (1934) regarding internal limits to firm size, Malmgren predominantly sought to exploit Marschak’s theory of information for the analysis of internal organization” (Klaes 2000: 571, footnote 10).

Malmgren combined the ideas of Coase, Hayek, Richardson and Penrose in such a way as to be able to examine ideas which have only begun to be examined in the mainstream theory of economic organisation in recent times.

Three central contributions have been identified in Malmgren’s work (Foss 1996: 349).

1. Malmgren ‘operationalised’ the Coaseian approach to the theory of the firm. He ‘operationalises’ - in the sense of Williamson (1985) – the Coaseian approach insofar as he analyses the determines of transaction costs which is something Coase did not investigate in any depth. Transactions within the firm may be less costly than across the market because of the firm’s ability to control information. Firms can provide ‘precedents’ and ‘customs’ which can act as a focal point which eliminates divergence of expectations. Thus ‘intra-firm’ transactions are less costly than ‘inter-firm’ transactions.

“Not only are a number of events predictable over the duration of the entire production plan, but also less information is required to describe that set of events for control purposes [ . . . ] operating rules of quite simple nature replace a more thorough analysis of every possible transaction which might arise in market determined allocation of resources over the set of activities which make up the firm”. (Malmgren 1961: 404).

2. Malmgren also managed to combine contractual and knowledge-based approaches to the firm and

3. Also he took an economic approach to notions such as ‘business culture’ which are still not well theorised.

Malmgren argued that if agents shared a common ‘business culture’ or ‘firm-specific mental constructs’ (Foss 1997: 192) (sometimes also referred to as ‘corporate culture’ (Cremer 1990) or ‘models of the world’ (Marengo 1995)) then getting the incentives right was the main objective of organisational design. But if different sections of a firm differ in their understanding of a given message, then creating a common knowledge base and getting a uniform ‘business culture’ so that everyone is on the same page becomes the major organisational objective. That is, Malmgren saw that the coordination of the within-the-firm division of knowledge required a shared ‘corporate culture’.

Along with this Malmgren’s work suggests it could be possible to construct an opportunism-free approach to the theory of the firm, something not contemplated in the economic mainstream even today. Malmgren’s approach sees firms as not as institutions that align incentives, but rather as organisations that control information. So while he takes an overall Coaseian approach it is something of a variation on the Coasian theme and a different variation from that of other later Coaseian followers.

That the firm is different from the market, in Malmgren’s framework, is because of its ability to store knowledge and simulate learning. Firms exist because they can more efficiently solve knowledge-related problems than can the market. The pooling of information in the firm lowers the cost ‘of discovering what the relevant prices are’ and the providing of ‘ ‘precedents’and ‘customs’ which can act as a focal point’ can help ‘complete’ the missing clauses in a long, (incomplete) open-ended employment contract. Thus firms save on information and transaction costs relative to the market. This provides an incentive to create firms.

But, Coase (1937) and Knight (1921) aside, all this post-1920 work has been to no avail as it has not been applied to modern mainstream thinking to do with the theory of the firm. This work represents ‘opportunities missed’ so that the first 50 years of the 1920-2020 period resulted in little of importance being contributed to the theory of the firm.

It had to wait until the 1970s before the theory of the firm took off. It was only post-1970 that the importance of Coase (1937) and Knight (1921) was recognised and the development of the contemporary theory of the firm got underway.

So counting from 1970, there has only been 50 years of the theory of the firm.

References:

- Arena, Lise (2021). Oxford’s Contributions to Industrial Economics from the 1920s to the 1980s. In Robert A. Cord (ed.), The Palgrave Companion to Oxford Economics (pp.75-100), Cham, Switzerland: Palgrave Macmillan.

- Boudreaux, D. and R. Holcombe (1989). `The Coasian and Knightian Theories of the Firm', Managerial and Decision Economics, 10(2) June: 147-54.

- Coase, Ronald Harry (1937). ‘The Nature of the Firm’, Economica, n.s. 4 no. 16 November: 386-405.

- Crémer, Jacques (1990). ‘Common Knowledge and the Coordination of Economic Activities’. In Masahiko Aoki, Bo Gustaffson and Oliver E. Williamson (eds.), The Firm as a Nexus of Treaties (pp. 53-76), London: Sage.

- Cristiano, Carlo (2015). `Theories of the Firm in England Before Coase: Stemming the Tide of `Rationalization' on the Eve of The Nature Of The Firm ', Journal of the History of Economic Thought, 37(4) December: 597-614.

- Demsetz, Harold (1988). ‘Profit as a Functional Return: Reconsidering Knight’s Views’. In Harold Demsetz, Ownership, Control, and the Firm: The Organization of Economic Activity, (vol. I pp. 236-47), Oxford: Basil Blackwell.

- Foss, Nicolai J. (1996). ‘Harald B. Malmgren’s Analysis of he Firm: lessons for modern theorists?’, Review of Political Economy, 8(4): 349-66.

- Foss, Nicolai J. (1997). ‘Austrian insights and the theory of the firm’. In Advances in Austrian Economics (Advances in Austrian Economics, Vol. 4, pp. 175-98), Bingley: Emerald Group Publishing Limited.

- Hébert, Robert F. and Albert N. Link (2006). `Historical Perspectives on the Entrepreneur', Foundations and Trends in Entrepreneurship, 2(4): 261-408.

- Klaes, Matthias (2008). ‘Transaction Costs, History Of’. In Steven N. Durlauf and Lawrence E. Blume (eds.), The New Palgrave Dictionary of Economics, 2nd edn., Basingstoke: Palgrave Macmillan.

- Knight, Frank H. (1921). Risk, Uncertainty and Pro t, Boston: Houghton Mifflin Company.

- Lavington, F. (1927). `Technical Influences on Vertical Integration', Economica, 7 (No. 19) March: 27-36.

- Malmgren, H. B. (1961). `Information, Expectations and the Theory of the Firm', Quarterly Journal of Economics, 75(3) August: 399-421.

- Marengo, L.(1995). ‘Structure, Competence, and Learning in Organizations?’, Wirtschaftspolitische Bläter, 42(6): 454-64.

- Plant, Arnold (1937). `Centralize or Decentralize?'. In Arnold Plant (ed.), Some Modern Business Problems: A Series of Studies (pp. 3-33), London: Longmans, Green and Co.

- Robinson, E. A. G. (1931). The Structure of Competitive Industry, London: Nisbet & Co.

- Williamson, Oliver E. (1985). The Economic Institutions of Capital ism, New York: The Free Press.

- Zouboulakis, Michel S. (2015). ‘Elements of a theory of the firm in Adam Smith and John Stuart Mill’. In George C. Bitros and Nicholas C. Kyriazis (eds.), Essays in Contemporary Economics: A Fests chrift in Memory of A. D. Karayiannis (pp. 45-52), Heidelberg: Springer.

Friday, 24 November 2023

Thinking about the theory of production/the firm

J. B. Condliffe has pointed out that

"[ ... ] economic activity and thoughts about it are as old a mankind'' (Condliffe 1974: 21)

and this is certainly true of thoughts to do with production and the firm.

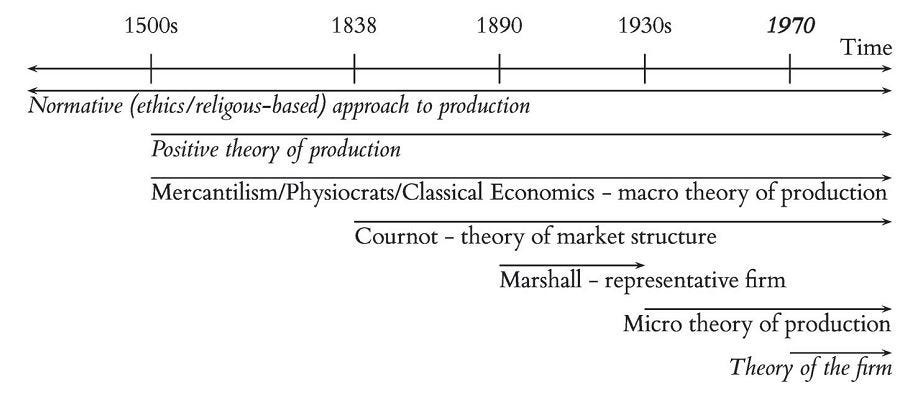

While thoughts about production were commonplace before, roughly, the 1500s, those thoughts were primarily normative in nature, they were about should questions rather than how questions. The questions were about what should be produced rather than how things are produced. After the 1500s a more positive approach to production was developed. In the beginning, this was a macro approach concerned with the production of the entire economy. During the 1800s an industry-level approach to production started to arise alongside the macro approach. By the 1930s the standard neoclassical textbook theory of production had been developed. But it was not until around 1970 that the theory of the firm, based on work from the 1920s and 1930s, began to supplement the various theories of production.

What concerns us here is the opportunities that were taken and those that were not in the development of the mainstream theory of the firm over the period 1920-2020. The 1920s are the earliest that ideas that have come to form parts of the contemporary economic theories of the firm were put forward.

The models that form the basis of the contemporary mainstream theory of the firm, are those of Frank Hyneman Knight (Knight 1921), better known for his work on risk and uncertainty, and Ronald Harry Coase (Coase 1937), who is the major influence on the contemporary economic theory of the firm. We can think of these as the 'opportunities taken'.

We can also examine the missed opportunities in the theory of the firm: the division of labour, which has produced theories of firm-level production but not theories of the firm, the 'rationalisation debate' which gave rise to partial theories of the firm, and the work of Arnold Plant (Plant 1937), who is better known for his work on copyright and patents, also provided, intentionally or not, detail and content regarding several aspects of Coase's arguments where those facets were left underdeveloped by Coase, and Harold Malmgren (Malmgren 1961) who provided the first extensive elaboration of Coase's 1937 analysis. All these works have not been developed in the mainstream theories of the firm and thus can be seen as 'opportunities missed' in the history of thinking to do with the firm.

What is not clear is why approaches to the firm from inside the mainstream of economics would be ignored by economists. Those coming from the heterodox writers use non-mainstream ideas and methods and thus it is likely that the mainstream will overlook their work. But this is not true of those ignored authors from within the mainstream, Why were their ideas not developed?

So the history of the theory of the firm can be thought about as a set of opportunities taken and missed with the interesting question being, Why were some opportunities taken but others missed?.

Refs.

Coase, R. H. (1937). 'The Nature of the Firm', Economica, n.s. 4 no. 16 November: 386-405.

Condliffe, J. B. (1974). Defunct Economists, Christchurch: Pegasus Press.

Knight, Frank H. (1921). Risk, Uncertainty and Profit, Boston: Houghton Mifflin Company.

Malmgren, H. B. (1961). 'Information, Expectations and the Theory of the Firm', Quarterly Journal of Economics, 75(3) August: 399-421.

Plant, Arnold (1937).'Centralise or Decentralise?'. In Arnold Plant (ed.), Some Modern Business Problems: A Series of Studies (pp. 3-33), London: Longmans, Green and Co.

Sunday, 11 December 2022

The history of the theory of production in one figure

Or, (almost) everything you wanted to know about the history of the theory of production/the firm: but were afraid (too bored) to ask

This post is based on “(Almost) everything you wanted to know about the history of the theory of production/the firm: but were afraid (too bored) to ask”, forthcoming in New Zealand Economics Papers. Thanks to Philip Meguire for his assistance with this post.

A picture is worth a thousand words

William Letwin writes that “[b]efore 1660 economics did not exist; by 1776 it existed in profusion” (Letwin 1964: vii) and this is largely true for the particular case of the theory of production. Through time we have seen various approaches being taken to the analysis of production and the firm within the mainstream of economic investigation. These approaches have run the gamut from normative analysis to positive analysis, from macroeconomics to microeconomics to micro-microeconomics and from theories of production to theories of the firm. The figure below outlines developments.

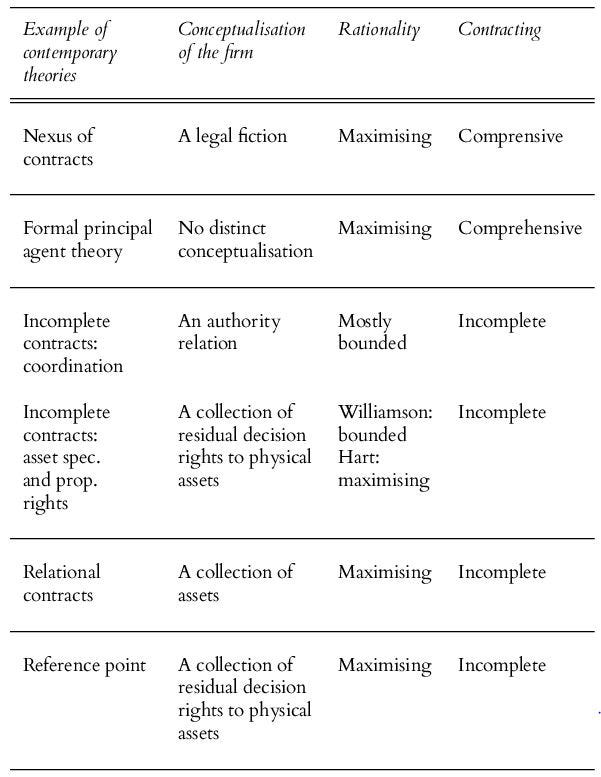

That 70s show

From the figure, we see that chronologically theories of production preceded theories of the firm. While not entirely accurate, 1970 is nonetheless a convenient dividing line between the theory of production and the theory of the firm proper. It was around this time that the theory of production began to be supplemented by a genuine theory of the firm. A distinguishing feature of much of the post-1970 literature is that it takes an incomplete contracts and maximising approach to modelling the firm. But not all contemporary approaches employ this particular combination of contracting and rationality however, some use comprehensive contracts theory while others utilise bounded rationality and incomplete contracts, see the table below.1

Before the 1970s the standard mainstream analysis of production/the firm was implicitly a complete contracts approach. This limited the applicability of their theories to the firm. As Oliver Hart has emphasised the complete contract theories can say little about the important questions to do with the firm,

"[...] if the only imperfections are those arising from moral hazard or asymmetric information, organisational form – including ownership and firm boundaries – does not matter: an owner has no special power or rights since everything is specified in an initial contract (at least among the things that can ever be specified). In contrast, ownership does matter when contracts are incomplete: the owner of an asset or firm can then make all decisions concerning the asset or firm that are not included in an initial contract (the owner has ‘residual control rights’)" (O. D. Hart, 2003, p. C70).

Small is beautiful

From, roughly, the 1930s to the 1970s what often went under the heading of the theory of the firm was, in reality, a theory of micro-level production but, significantly, it was production but without firms. Firms are unnecessary in a world of zero transaction costs (Coase, 1937). The organising framework was that of market structure, eg. monopoly, oligopoly, perfect competition etc.

Before the 1930s the microeconomic approaches to production also concentrated on market structure rather than the firm itself. The proto-neoclassicals created theories of monopoly, oligopoly and an only partially developed theory of perfect competition. The leading attempt at modelling production in the post-1870s neoclassical period was Marshall’s ‘representative firm’.

Thinking big

Before these micro approaches came the modelling of aggregate or macroeconomic production. This began in the sixteenth century with the Mercantilists and continued with the Physiocrats and the classical economists.

Ethics, not economics

For the period before the 1500s the predominant approach to production was ethically or religious based. The questions asked were mainly normative with little attempt made to consider production from a positive perspective. Questions were asked about what should be produced or what production or occupations would find favour with God or what production was ethically justified. As Whittaker (1940, p. 362) explains, with respect to the early Christian era, “[i]n production, as in everything else, the Christian man was to be a servant of God, occupying himself only in those activities that received divine favor”.

Moving from a normative to a positive framework set a chain of developments in motion which, eventually, resulted in the contemporary theories of production and the firm. We will briefly outline this sequence of events up to 1970 beginning with aggregate approaches to production

The State replaces God

Whittaker (1940, p. 716) argues that in medieval Europe economic thought was subordinate to Christian morals and it was only with the appearance of mercantilism that this changed. He suggests that within mercantilism the State replaced God in the discussion of wealth and production. Mercantilism requires a dominant state to create and enforce monopolies as well as to regulate and control both domestic and international trade and direct the economy in general. While there is discussion of production/the firm in the mercantilist literature, it is a limited discussion, limited both in the sense that it deals not with issues to do with firms per se, but rather with the effects of firms on more macro issues such as the balance of trade, and in the sense that it deals mostly with the regulated companies and their monopolies.

While the regulated companies often came under attack, for various reasons, they were not without their defenders. But it is important to note that many of the arguments made were simply partisan rent-seeking, with each side just dressing up their position in terms of the general welfare. It is also worth observing that the arguments made were more policy-relevant than theory relevant. Although the debates involve ‘firms’ they did not require a theory of the firm or firm-level production. For the evaluation of policy, there is no need for any explanation of what a firm is, what its boundaries are or what its internal organisation is. As limited as the discussion was, it was, importantly, a positive analysis.

The French connection

In chronological order, the mercantilists were followed by the physiocrats. Physiocracy aimed to analyse the determinants of the general level of economic activity and such an endeavour required a positive framework. Within physiocracy, the key factor determining the level of economic activity was the capacity of agriculture to yield a ‘net product’. By this, the Physiocrats meant that the wealth of a nation was determined by the size of any surplus of agricultural production over and above whatever is required to support agriculture (by feeding farm labourers etc). It was argued that it was only when labour was applied to land that it created a surplus which was over and above what was required for its maintenance. It was out of this surplus that all other classes in society were supported. Agriculture alone was productive, it alone produces the ‘net product’. Other classes in society were stipendiary, sterile or unproductive.

To see the difference between productive and unproductive note that the Physiocrats believed that the artisan sold his output for a payment that covered (1) his production costs plus (2) subsistence wages for himself, while the cultivator received an amount that covered (1) his production costs plus (2) his subsistence wages plus (3) a surplus, which would be paid to the landowner as a rent. Thus productive means productive of a surplus (Whittaker, 1940, pp. 369–70).

Giorgio Gilibert argues that the physician and leading physiocrat Francois Quesnay saw agriculture as productive because, as noted above, it generated a surplus (rent). But non-agricultural activities could be seen as productive if the assumption that rent was the only form of surplus was dropped. If profit is seen as a legitimate form of surplus then other activities can be productive. Adam Smith and the classical economists made this move (Gilibert, 2008, p. 823).

Production takes centre stage

With the development of classical economics, production became one of the main topics of political economy. Cannon (1917, p. 28) comments that

“[b]efore the middle of the eighteenth century a theory of production can scarcely be said to have existed.”

He adds when surveying early English economic treatises that,

“ ‘Production’ and ‘Distribution’ do not seem, however, to have been used in England before 1821 as titles of divisions of political economy; and, before Adam Smith wrote, they were not in any sense technical economic terms” (Cannon, 1917, p. 26).

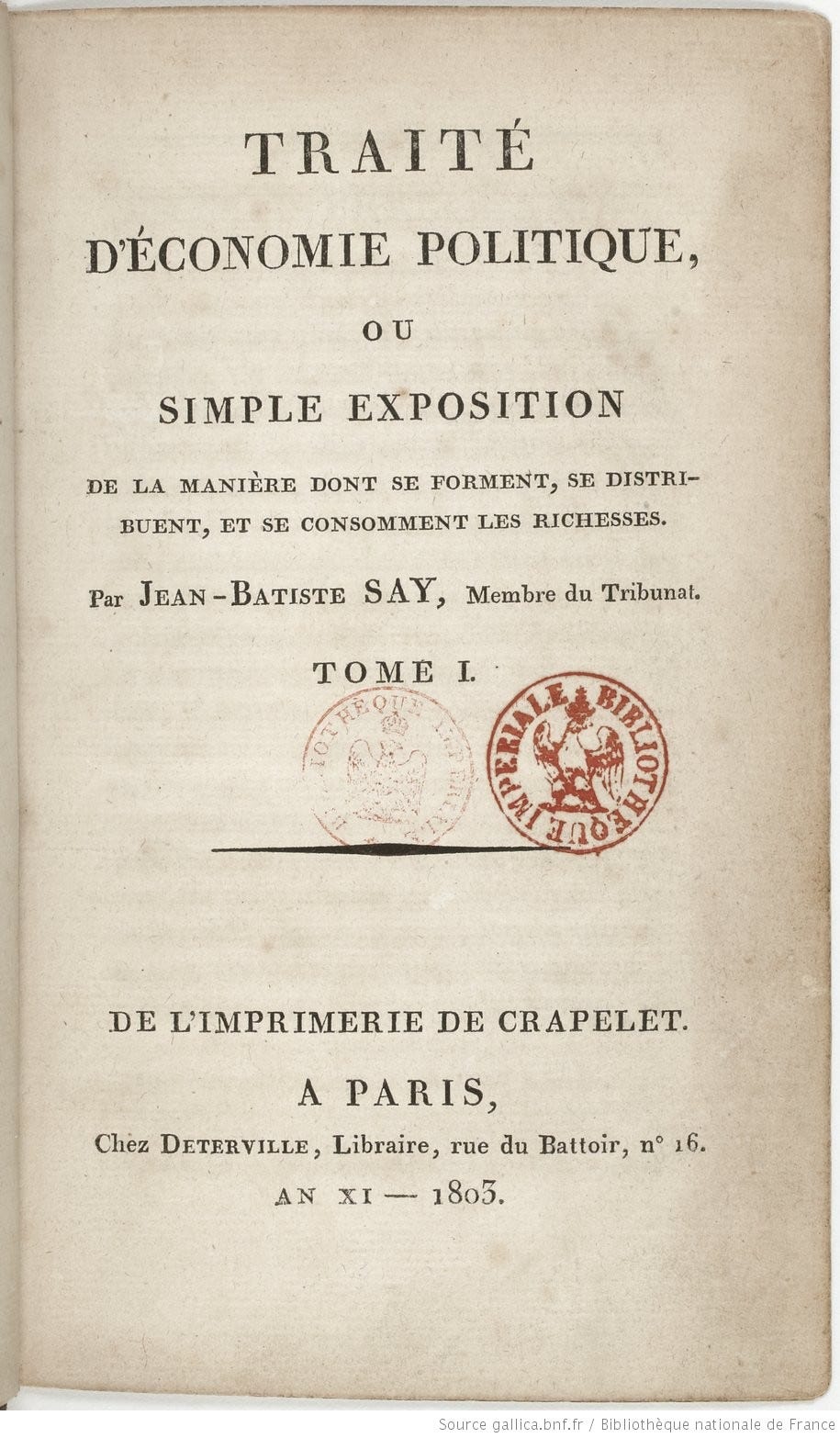

Post-Smith production become one of the major divisions of economies. One example of this new emphasis can be seen in Book 1 of the Frenchman Jean-Baptiste Say’s 1803 book, ‘Traité d'économie politique ou simple exposition de la manière dont se forment, se distribuent et se composent les richesses’ (‘Treatise on Political Economy, or A Simple Exposition of the Manner in Which Wealth is Formed, Distributed and Composed’) which is entitled ‘On Production’.2 Some forty-seven chapters are devoted to the discussion with the factors of production being land, labour and capital.3 In 1821 Scots-born James Mill, following Say, opened this ‘Elements of Political Economy’ with a chapter on ‘Production’, which he divides into two sections: labour and capital. Another example is chapter two of Irish-born Robert Torrens’s ‘An Essay on the Production of Wealth’, also published in 1821, which is devoted to production with his ‘instruments of production’ being land, labour and capital.

The classical economists followed the mercantilists and Physiocrats in that their general approach to the economy was predominately a macroeconomic approach. O’Brien (2003, p. 112) remarks that,

“[c]lassical economics ruled economic thought for about 100 years [roughly 1770-1870]. It focused on macroeconomic issues and economic growth. Because the growth was taking place in an open economy, with a currency that (except during 1797-1819) was convertible into gold, the classical writers were necessarily concerned with the balance of payments, the money supply, and the price level. Monetary theory occupied a central place, and their achievements in this area were substantial and - with their trade theory - are still with us today”.

Thus the theory of production that emerged from classical economics aimed to explain the production of an entire economy. Edwin Cannan writes, concerning the period 1776-1848,

“ ‘Production’ and ‘distribution’ in political economy have always meant the production and distribution of wealth” (Cannan,1917, p. 1).

This is the opening sentence of a chapter on “The Wealth of a Nation” (Cannan, 1917, chapter 1). It was the production of aggregate wealth that was an issue of interest.

But, importantly, their theory was a positive theory of aggregate production that did not have the ethical overtones of the pre-seventeenth century writers. This set the tone for the theories, including the microeconomic theories, that followed.

The French connection 2

Antoine Augustin Cournot’s major economics work was ‘Researches into the Mathematical Principles of the Theory of Wealth’ (Cournot, 1838). It is this work that first laid out our basic models of monopoly, duopoly, oligopoly and the beginnings of perfect competition. That is, this work supplied us with our basic microeconomics models of market structure.

While Cournot is known to all economists today, it required something of a rediscovery in the 1960s for him to become a standard part of the economic landscape. It was only after the usefulness of game theory become recognised, and it was realised that the Cournot equilibrium is just a form of the Nash equilibrium, that Cournot become hailed as an economic innovator.

But Cournot’s famous contributions can be seen more as theories of industries or markets, rather than as theories of the firm per se. In modern terms, he was doing industrial organisation rather than organisational economics.4

Cournot has been described as a ‘proto-neoclassical’. Proto-neoclassicals are pre-1870 writers who were developing neoclassical-like techniques before the commonly accepted founding of neocalssiacal economics by Jevons, Menger and Walras in the 1870s. After its inception, the most important contribution to neoclassical economics was made by Alfred Marshall who codified these, at the time, new ideas for economists with the publication of his hugely influential book ‘Principles of Economics’ in 1890.

Marshalling the troops firms

In his Principles, Marshall’s approach to production makes use of the idea of the ‘representative firm’. Hartley (1996) starts his exploration of the representative firm by arguing that Marshall’s motivation for creating the representative firm was to avoid having to assume that all firms were identical.

The representative firm was part of Marshall’s answer to the problem of constructing an industry supply curve which shows in a two-dimensional (own-price/output) space an inclusive relationship involving other prices and other quantities. In such an environment a movement along the supply curve involves a change in many economic variables, such as input prices and other product prices.

Note that for Marshall a supply schedule shows what the minimum price has to be to ensure producers are willing to produce a particular quantity. This minimum price must cover the average costs of the highest-cost producer and the supply curve shows how these costs change as the industry output increases. This stands in sharp contrast to the now-standard microeconomic textbook approach to industry supply in which all prices are assumed to be constant apart from the price of a particular commodity, and then output – of both the individual price-taking firm and of the industry – is taken to be a function of only that price (Opocher & Steedman, 2008, p. 247). The modern supply curve shows how much an industry will supply at any given price.

Marshall gave us the famous metaphor of an industry being like a forest - while it might appear unchanged if considered as a whole, the individual trees that make it up are constantly changing. It was to reconcile his dynamic view of individual firms with the static view of industries that Marshall introduced the idea of the representative firm. The representative firm incorporates the relevant cost and business conditions of all firms in the industry.

Controversy ensued

What is now referred to as the ‘cost controversy’ consisted of a series of papers published in the 1920s and early 1930s which debated aspects of Marshallian economics. The representative firm was a casualty of this controversy. Wolfe (1954) places responsibility for the expunging of the representative firm from the economics literature firmly at the feet of two papers, Sraffa (1926) and Robbins (1928).

Hartley (1996, pp. 172–174) summarises the attacks on the representative firm by arguing that they made four major claims: (1) Robbins claimed the representative firm was ephemeral. (2) He also argued that its use gained nothing.

“There is no more need for us to assume a representative firm or representative producer, than there is for us to assume a representative piece of land, a representative machine, or a representative worker” (Robbins, 1928, p. 393, emphases in original, footnote deleted).

Marshall used the representative firm to show how heterogeneous firms could generate a single market price but Sraffa (1926) argued that in equilibrium different producers could charge different prices for similar commodities. In modern terms think of, for example, monopolistic competition. Thus there is no need for the representative firm. (3) Young (1928) showed that the representative firm can not account for economic expansion other than that generated by the expansion of current manufacturing processes. Marshall’s view was that as an industry grew the representative firm grew proportionally. This is what is meant by the supply curve remaining relevant. Young (1928) pointed out that as the economy grew the division of labour expanded so that commodities once produced by one firm could now be made by multiple firms, each single firm specialising in producing just one part of the good. Young (1928, p. 538) writes

“[w]ith the extension of the division of labour among industries the representative firm, like the industry of which it is a part, loses its identity. Its internal economies dissolve into the internal and external economies of the more highly specialised undertakings which are its successors, and are supplemented by new economies”.

Thus if we have growth we must ask, what happens to the representative firm? During a period of growth, the representative firm may cease to be representative. Even if all firms are the same, and growth occurs due to an increase in the number of firms, then the representative firm does not grow with the industry. (4) Robbins (1928, p. 399) writes

“The whole conception, it may be suggested, is open to the general criticism that it cloaks the essential heterogeneity of productive factors–in particular the heterogeneity of managerial ability–just at that point at which it is most desirable to exhibit it most vividly”.

The reason Marshall created the representative firm in the first place was to create a single supply curve with heterogeneous firms. Implicit in this formulation is the idea that the supply curve will be the supply curve of the representative firm. But why? Why not some other firm? The marginal firm, for example. Marshall argues that if a manager sees the representative firm making profits he will enter the market. This increases supply and forces down the market price. This process will end when the price equals the costs of the representative firm and hence this firm’s profits will be zero. But for price to equal the costs of the representative firm, all managers would have to be of average ability. If there were managers of superior or inferior ability the supply price could be forced away from the representative firm’s cost to some other firm’s costs, e.g. the marginal firm’s costs. But by assuming that managers are all average Marshall is forgetting the heterogeneities he began with.

These criticisms were remarkably effective the representative firm was driven from the literature remarkably quickly.

Equilibrium (firm) is reached

In response to the attacks, A. C. Pigou argued (Pigou 1928) that for carrying out comparative static analysis,

“Marshall’s highly complex analytical starting point in a population of heterogenous disequilibrium firms was, strictly speaking, unnecessary. Pigou insisted on the possibility-and, indeed, desirability-of eliminating this complexity” (Foss, 1994, p. 1121).

Pigou’s elimination of complexity involved the introduction of the now standard ‘equilibrium firm’.

So the representative firm was replaced with little difficulty in part because there was a ready-made replacement. Today the textbook model of the ‘firm’ (or more correctly the neoclassical model of micro-production) is based not on Marshall, but rather on Pigou. The equilibrium firm has become the standard.

Including Pigou’s creation of the equilibrium firm (Pigou 1928), Moss (1984) argues that there were three steps in the development of the neoclassical theory of production:

“[w]ithout Pigou’s analytical use of the industry [step one] and his invention of the equilibrium firm [step two], we could not have had the ‘firm’ of the neoclassical theory. None the less, the now conventional conception of the firm was left incomplete by Pigou in two respects. First, Pigou himself did not assume that the industry was comprised entirely of equilibrium firms, but only that an equilibrium firm could be constructed from the law of returns (increasing, constant or diminishing) obeyed by any industry. Second, Pigou did not assume the firm qua production function to be facing household preference functions. It was the inclusion of these two elements that constituted the third step in the creation of the firm analysed in the neoclassical theory of the firm”.

Although there were some preliminaries “[…] this final step was completed by Robinson (1933) and Chamberlin (1933)” (Moss, 1984, p. 313).

Note this third step was the kind of assumption Marshall tried so hard not to make. Robinson and Chamberlin made the move in their models of imperfect competition and monopolistic competition, respectively (Chamberlin, 1933; Robinson, 1933). In these models, industries are comprised entirely of equilibrium firms which have identical cost curves, and firms, as production functions, faced household preference (demand) functions. But as Moss (1984, p. 314) also points out,

“[b]y assuming that every firm in the industry has an identical cost curve, Robinson and Chamberlin stood Pigou’s construction of the equilibrium firm on its head. Where Pigou argued that an equilibrium firm could be derived from the laws of returns obeyed by any particular industry, Robinson and Chamberlin defined the industry on the basis of a population of equilibrium firms”.

With this change in the interpretation of the relationship between the equilibrium firm and the industry, the neoclassical approach to production had finally developed.

Thinking big good, thinking small better

The first of the positive mainstream theories of production were theories of aggregate production which aimed to explain the production of the economy as a whole. These theories were driven by the issues that the mercantilists and physiocrats were addressing. Issues to do with the wealth of a country, the balance of trade or the drivers of economic activity require a positive theory of wealth and production but it is a theory of aggregate wealth and production. The classical economists were also primarily concerned with macroeconomic problems such as growth, trade, the balance of payments, the money supply and the price level and their modelling of production reflected this.

The beginning of mainstream micro-level production theory is Cournot’s theories of monopoly, oligopoly and his initiation of the theory of perfect competition. As O’Brien (2004, p. 67) has emphasised the core of neoclassical economics is the theory of microeconomic allocation. This emphasis meant that relative prices become the principal object of analysis. This analysis utilised micro-level theories rather than the macro-level theories of previous generations of economists.

No firms please, we’re British (and French)

When considering the representative firm a point worth noting is that Marshall spent much time studying real industries and firms and while these studies certainly influenced his approach to the theory of the firm there is a tension between his desire to base his representative firm on real firms and the use of an implicitly zero transaction cost framework for his theoretical modelling of the firm. The use of a zero transaction cost framework implies that there is no role for firms in his theory of production (Coase, 1937).

Zero transaction costs also imply there is perfect and costless contracting. This reinforces the production without firms conclusion since in such a situation “[...] it is hard to see room for anything resembling firms (even one-person firms), since consumers could contract directly with owners of factor services and wouldn’t need the services of the intermediaries known as firms” (Foss, 2000, p. xxiv).

Marshall’s representative firm is therefore not a theory of the firm. The "firms" that lie along the particular expenses curve5 are just groupings of factors of production bought together and controlled by market contracts. In addition, Marshall’s theory can not answer the three core questions that underlie the post-1970 mainstream theory of the firm: (1) why do firms exist?; (2) what determines the boundaries of the firm?; and (3) what determines the internal structure of the firm? Marshall's 'firms' are just collections of cost curves, they have no real existence, no boundaries and no internal organisation. Thus the Marshallian modelling process can be interpreted as one which begins with production involving real firms but ends with a model of production involving no firms at all.

Cournot’s theories of market structure as well as Pigou's equilibrium firm, and therefore the standard neoclassical models of production, are also zero transaction cost models and thus also models of production without firms. These models can not answer the three basic post-1970 questions either. The (proto-)neoclassicals were not interested in the firm as such, they were, to abuse Marshall's famous analogy, more interested in the forest than in the trees.

When smaller is more

In general, as the questions asked began to concern, in a sense, ‘smaller’ units of analysis more micro approaches to production/the firm started to be developed. Harvey Leibenstein has argued that such a move to smaller units of analysis has occurred in most sciences,

“[i]n the life history of most sciences there are movements toward the study of larger aggregates or toward the detailed study of smaller and more fundamental units. My impression is that in most fields the movement toward the study of more micro units has predominated” (Leibenstein, 1979, p. 477).

Macroeconomic problems required a theory of aggregate production, market structure analysis needed a microeconomic theory of production, and when questions finally started to be asked about the existence, boundaries and internal structure of organisations a theory of the firm, involving Leibenstein’s ‘micro-microeconomics’, began to appear. In the 1970s the theory of production was belatedly supplemented by a theory of the firm. It was only then that theories that aimed to answer the three core questions to do with the firm referred to above, came to the fore. It was then that organisational economics began to emerge as a separate discipline. A discipline for which there is no justification for being either afraid of it or bored with it.

Refs.:

Chamberlin, E. H. (1933). The theory of monopolistic competition. Cambridge, MA: Harvard University Press.

Cannan, Edwin (1917). A History of the Theories of Production and Distribution in English Political Economy From 1776 to 1848, 3rd edn., London: P. S. King & Son.

Cannan, Edwin (1929). A Review of Economic Theory, London: P. S. King & Son.

Coase, R. H. (1937). ‘The nature of the firm’. Economica, 4(16), 386–405.

Foss, N. J. (1994). ‘The biological analogy and the theory of the firm: Marshall and monopolistic competition’. Journal of Economic Issues, 28(4), 1115–1136.

Foss, N. J. (2000). ‘The theory of the firm: An introduction to themes and contributions’. In N. Foss (Ed.), The theory of the firm: Critical perspectives on business and management (pp. xv–lxi). London: Routledge.

Gilibert, G. (2008). ‘Classical theories of production’. In S. N. Durlauf & L. E. Blume (eds.), The new palgrave: A dictionary of economics, 2nd ed. (pp. 823–826). London: Palgrave Macmillan.

Hart, O. D. (2003). ‘Incomplete contracts and public ownership: Remarks, and an application to public-private partnerships’. Economic Journal, 113(486), C69–C76. No. 486 Conference Papers March: C69-C76.

Hartley, J. E. (1996). ‘The origins of the representative agent’. Journal of Economic Perspectives, 10(2), 169–177.

Leibenstein, H. (1979). ‘A branch of economics is missing: Micro-micro theory’. Journal of Economic Literature, 17(2), 477–502.

Letwin, William (1964). The Origins of Scientific Economics. New York: Doubleday and Company, Inc.

Moss, S. (1984). ‘The history of the theory of the firm from Marshall to Robinson and Chamberlin: The source of positivism in economics’. Economica, 51(203), 307–318.

O’Brien, Denis P. (2003). ‘Classical Economics’. In Warren J. Samuels, Jeff E. Biddle and John B. Davis (eds.), A Companion to the History of Economic Thought (pp. 112-129), Oxford: Blackwell Publishing Ltd.

O’Brien, Denis P. (2004). The classical economists revisited. Princeton: Princeton University Press.

Opocher, A., & Steedman, I. (2008). ‘The industry supply curve: Two different traditions’. The European Journal of the History of Economic Thought, 15(2), 247–274.

Pigou, A. C. (1928). ‘An analysis of supply’. Economic Journal, 38(150), 238–257.

Robbins, L. (1928). ‘The representative firm’. Economic Journal, 38(151), 387–404.

Robinson, J. (1933). The economics of imperfect competition. London: Macmillan and Co., Ltd.

Schenk, H. (2005). ‘Organisational Economics in an Age of Restructuring, or: How to Corporate Strategies Can Harm Your Economy?’ In P. de Gijsel and H. Schenk (eds.), Multidisciplinary Economics: The Birth of a New Economics Faculty in the Netherlands (pp. 333-65), Dordrecht: Springer.

Sraffa, P. (1926). ‘The laws of returns under competitive conditions’. Economic Journal, 36(144), 535–550.

Whittaker, E. (1940). A history of economic ideas. New York: Longmans, Green and Co.

Wolfe, J. N. (1954). ‘The representative firm’. Economic Journal, 64(254), 337–349.

Young, A. A. (1928). ‘Increasing returns and economic progress’. Economic Journal, 38(152), 527–542.

Footnotes:

Friday, 25 November 2022

Coase on profit maximisation

"[i]t would be Utopian to imagine that a businessman, except by luck, could manage to attain this position [MR=MC and the avoidable costs of the total output less than the total receipts] of maximum profit" (Coase 1981: 102)and

"[t]his being so, it seems to me that any claim that modern cost accounting (at any rate in the form in which it is to be found in the textbooks) enables unprofitable lines to be discovered and eliminated is misleading. It is only possible to discover whether or not a particular activity is profitable by comparing the avoidable costs with the receipts. And this, as I understand it, is a task which modern cost-accounting methods do not enable one to perform" (Coase 1981: 113).But he does also seem to have seen it as a useful tool for economic investigation:

"[w]ell, all this suggests that economists are satisfied. Now the fact is that they are satisfied. They are very pleased. To go to a meeting of the American Economic Association is to see thousands of self-satisfied economists. Now there is a reason why this is so. They have found economics useful and are quite happy therefore to go on using it. Now it’s true: it is useful. The concepts which have been developed for handling various problems are useful for handling a wide range of problems. Opportunity costs, supply and demand schedules, marginal costs, marginal revenues, maximization of profits – they’re all very useful concepts that you can use, and not simply for economic problems but for others as well" (Coase 2002: 4).and

"[n]ow take a person in a firm situation. A man who buys something for 10 dollars and sells it for 8 dollars doesn't last very long. There's an immediate punishment that comes in within the economic system if you don't try to maximise profits and so on. So, I'm very happy with the assumption that people make, that firms make profits. And you can study what firms do and of course, it fits very nicely. They drop the lines that make losses. They expand the lines that make profits and so on. So, I make this difference between people acting in the productive system and people acting as consumers" (Coase in Becker 1995).When discussing the nature of opportunity costs, Coase writes,

"[t]his particular concept of costs would seem to be the only one which is of use in the solution of business problems, since it concentrates attention on the alternative courses of action which are open to the businessman. Costs will only be covered if he chooses, out of the various courses of action which seem open to him, that one which maximizes his profits. To cover costs and to maximize profits are essentially two ways of expressing the same phenomenon. In practice it is probably better to regard the cost of doing anything as the highest alternative receipts that might have been obtained rather than vaguely as all the alternatives that are open" (Coase 1981: 108).In a comment on Heflebower (1955) - which critically examined one attack on the standard neoclassical model including profit maximisation, that of full cost pricing - Coase wrote that he wasn't yet ready to give up on the standard marginal analysis:

"I am not willing on the basis of the arguments brought forward so far to abandon ordinary marginal analysis (taking account of demand) as a first approximation. It is clearly not the whole story and there is need for much more research on business behavior. But we should not be disappointed if a good deal of economic theory turns out to be usable after our investigations are completed" (Coase 1955: 394).

Refs.:

- Becker, Gary S. (1995). 'Gary Becker Discussions: Consumer Behavior'. Video of discussion between Gary Becker and Ronald Coase on the question of, Is the economic theory of utility a useful way of understanding consumer behavior? Available at https://www.freetochoosenetwork.org/ideachannel/ic_program.php?itemId=65

- Coase, Ronald Harry (1937). `The Nature of the Firm', Economica, n.s. 4 no. 16 November: 386-405.

- Coase, Ronald Harry (1955). 'Comment' (on Heflebower (1955)). In Universities-National Bureau Committee for Economic Research, Business Concentration and Price Policy (pp. 392-4), Princeton: Princeton University Press.

- Coase, Ronald Harry (1981). 'Business organization and the accountant'. In J.M. Buchanan and G.F. Thirlby (eds.), L.S.E. Essays on Cost (pp. 95-132), New York: New York University Press.

- Coase, Ronald Harry (2002). 'Why Economics Will Change: Remarks at the University of Missouri, Columbia, Missouri, April 4, 2002', International Society for New Institutional Economics Newsletter, 4(1) Summer: 1, 4-7.