Nestle SA, the world's biggest food and drink company, says it has temporarily closed its production site in the Zimbabwe capital because employee security is no longer guaranteed.How temporary is temporary? What incentives does this give Nestle, and other companies in Zimbabwe? Obviously the supply of Nestle's products in Zimbabwe must be affected, as will the income of the employees of the firm. Anyone what to take a bet on what will happen to private foreign investment in Zimbabwe? If there is anywhere in the world that needs foreign investment, Zimbabwe would be it. This kind of action isn't the way to attract it. Arbitrary government action of this type only increases regime uncertainty at a time when Zimbabwe can lest afford it. Long-term private investment must be reduced because what remains of investors' confidence in the durability of private property rights is further eroded.

Nestle's factory in Harare on Saturday received an unannounced visit from Zimbabwean government officials and authorities who forced it to unload a truck of milk, the company said.

Police questioned two local managers and released them without charges the same day, Nestle said in a statement.

"Since under such circumstances normal operations and the safety of employees are no longer guaranteed, Nestle decided to temporarily shut down the factory,'' it said.

Nestle announced in October that it stopped buying milk from eight farms, including one that appears to belong to the family of President Robert Mugabe.

The company had temporarily bought milk from these farms because the government was unable to buy it and the country's dairy industry risked to collapse.

When the government in October resumed purchasing milk from the eight farms, Nestle said it would end the temporary purchases.

But since then Nestle has faced pressure to continue buying milk from these farms, a demand it has refused.

Showing posts with label Zimbabwe. Show all posts

Showing posts with label Zimbabwe. Show all posts

Monday, 4 January 2010

How not to run an economy

The following report comes via stuff.co.nz,

Monday, 21 December 2009

Zimbabwe switches into official monthly deflation

This piece of news comes from the Mail & Guardian Online.

Zimbabwe, for years plagued by hyper-inflation, has switched narrowly into an absolute price fall on a monthly basis, official data showed on Friday, following adoption of foreign currencies.The adoption of foreign currencies is behind the fall,

The central statistics office said that prices in November were 0,1% lower than in October when monthly prices had shown a rise of 0,8%.

The total disinflationary change from October to November is therefore 0,9 percentage points.

Since January, inflation has slowed rapidly after the country shelved use of the local currency and adopted various currencies such as the dollar, South African rand, British pound and Botswana pula.So if you can stop governments printing money you can stop inflation.

Wednesday, 27 May 2009

Hope for Zimbabwe?

A new report on the state of the economy and society in Zimbabwe along with a program for reform has been released by 9 think-tanks from throughout Africa. The report, The Zimbabwe Papers: A Positive Agenda for Zimbabwean Renewal , is written by members of think-tanks from Zimbabwe, Ghana, Nigeria, Guinea, South Africa, Burkina Faso and Zambia.

The report is clear about what the main driver of Zimbabwe's problems is

The report goes on to say,

The report also considers water markets and the health care sector. Zimbabwe's water shortages could be eliminated if ownership rights to water were assigned and prices deregulated. Zimbabwe's health care system could be improved by reducing import taxes on pharmaceuticals and cutting regulation. It is also explained how deregulation of labour markets, business, and communications are needed for the recovery of Zimbabwean economy.

Its a bold program but then the problems are huge.

The report should be required reading for those at The Standard who believe that Zimbabwe's problems are due to Mugabe’s government following the IMF and World Bank’s neo liberal plan for their economy to the letter!

The report is clear about what the main driver of Zimbabwe's problems is

The suffering of the Zimbabwean people is not the consequence of historical or external factors. It is entirely due to policies adopted, decisions made, and actions taken by the government of Zimbabwe. Many people have been the victims of violence perpetrated by the government, the institution that was supposed to protect them and provide them with an institutional environment in which they could lead happy and productive lives.The reports notes that

Zimbabwe's hyperinflation has crippled the country, led to political unrest, a massive "brain drain" to other countries, and produced an 80 percent decline in living standards over the last 10 years.Is there anywhere else in the world where living standards have drop by so much in such a short time? The report explains that while nearly every country in the world has over the pasted decade experienced at least some economic growth, people in Zimbabwe have seen their per capita incomes decline by more than two-thirds. By the standard of conventional economic indicators Zimbabwe has had the worst economic performance of all countries for which comparable data exists. This drop in income has resulted in tremendous suffering.

For example, since 1998, the average life expectancy for Zimbabweans declined from 55 years to 35 years. More than 80 percent of the adult population is unemployed. Nearly half of all Zimbabweans are at risk of malnutrition and starvation. Compared to sub-Saharan African averages, Zimbabwe's children face higher rates of mortality, suffer more malnourishment, and experience the worst from stunted growth. The children who make it to adulthood are more likely to suffer from disease and face constant threats of politically motivated, State-sponsored violence.And, to be fair, sub-Saharan African averages are not the highest standards in the world to met.

The report goes on to say,

While many claim that Zimbabwe's faltering economy is the result of sanctions imposed on Zimbabwe by Western governments, there is little evidence for this claim. In fact, the claim is patently false: Zimbabwe's economic decline and corrupt rule preceded sanctions by several years, which suggests that sanctions could not have possibly caused the crisis. Rather than point fingers at the West, we think Zimbabwe's leadership needs to look in the mirror and accept that most of their problems are the result of misguided internal policies. Reversing bad policies and the perverse incentives created by these policies therefore requires looking inward and finding ways to reform the domestic economy.Clearly much reform is much needed, Zimbabwe needs to rediscover the rule of law, constrain government, and grant their citizens important economic and political rights. The report sets out a blueprint for reform based on the idea,

[...] that for Zimbabwean renewal to occur, reformers must be committed to reduce government intervention, so that individuals have greater economic, personal, and political freedom.The report goes on to discuss

[...] the key economic reforms needed in monetary policy, fiscal policy, and trade. Zimbabwe's inflation has arguably been the single biggest contributory factor in Zimbabwe's collapse; we argue that Zimbabwe's government needs to cut spending and quit printing money. Zimbabwe's taxes are high and opaque; we recommend a flat tax and argue for reducing the total number of different taxes. Zimbabwe's trade barriers are also high, and customs processes hamper trade flows.The important the role that property rights can play in Zimbabwe's recovery are discussed. The report argues for widespread privatisation of de facto rights as a way to empower the poor. It is also argued that lower taxation on mineral rights and the elimination of the Indigenisation and Empowerment Act could encourage greater foreign direct investment in mining. And I'm guessing that there isn't much in the way of foreign direct investment going on right now.

As the country moves towards Free Trade Areas (FTAs), we recommend lowering trade barriers and improving incentives for customs officials.

The report also considers water markets and the health care sector. Zimbabwe's water shortages could be eliminated if ownership rights to water were assigned and prices deregulated. Zimbabwe's health care system could be improved by reducing import taxes on pharmaceuticals and cutting regulation. It is also explained how deregulation of labour markets, business, and communications are needed for the recovery of Zimbabwean economy.

Costly labour laws cause unemployment and raise employer costs; we argue that many of the laws are unnecessary and should be eliminated. In terms of regulatory delays and licensing processes, Zimbabwe is one of the worst places to start a business; we recommend a streamlining of business regulations and the establishment of a one-stop business start-up office. Zimbabwe's communications systems are out of date and highly centralized; they should be privatised and foreign entrants should be granted access to Zimbabwe's markets in order to generate efficiency-inducing competition.The last sections of the report look at political and legal reforms. Obviously the power of the state must be limited by the upholding of the rule of law. Violence must be reduced via more state transparency and by allowing more personal self-protection. Free speech must be guaranteed to all as a powerful check on the excesses of the government.

Its a bold program but then the problems are huge.

The report should be required reading for those at The Standard who believe that Zimbabwe's problems are due to Mugabe’s government following the IMF and World Bank’s neo liberal plan for their economy to the letter!

Wednesday, 20 May 2009

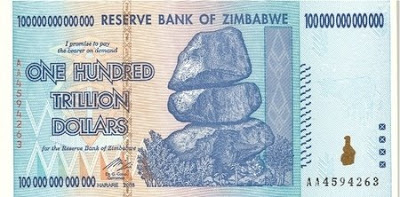

What one hundred trillion dollars looks like

At least in Zimbabwe

And its not worth the paper its printed on. Its worth more as a collectors item than it can buy.

(HT: The Adam Smith Institute)

And its not worth the paper its printed on. Its worth more as a collectors item than it can buy.

(HT: The Adam Smith Institute)

Saturday, 25 April 2009

Seriously bizarre (updated x2)

Even by the non-standards of The Standard this has got to be seriously bizarre,

All of this had nothing to do with the IMF or the World Bank. There are many things you may be able to blame these organizations for, but the situation in Zimbabwe isn't one of them. Zimbabwe's terrible, horrifying, economic and social conditions have but one cause, Robert Mugabe. To claim otherwise is totally bizarre, even for "The Standard".

Update: Liberty Scott comments here and Brad Taylor here.

Update 2: The Inquiring Mind inquires here.

It seems that Zimbabwe is, after all, a world leader. Mugabe’s government which followed the IMF and World Bank’s neo liberal plan for their economy to the letter, has shown us all how these policies will finish up.Exactly when did the IMF or the World Bank, or anyone else for that matter, say create an annual inflation rate of 89,700,000,000,000,000,000,000% and in the process totally destroy your currency so that you have to start using the US dollar? Or when did the IMF or the World Bank, or anyone else for that matter, say totally ignore property right and take over farms without compensation and give them to political supporters and in the process totally destroy your agricultural sector and with it most of your economy? As this 2008 report notes

The austerity medicine prescribed for Zimbabwe by the world Bank, Included oppressive and harsh debt repayment, and massive tax cuts for the rich, all funded by the privatisation of virtually every public service and national asset, and by slashing the ’social wage’.

Zimbabwe, once the bread basket of southern Africa, is reeling from its worst economic crisis since independence from Britain in 1980.When did the Zimbabwe government privatise anything much? As this 2009 report explains

The crunch is widely blamed on mismanagement by Robert Mugabe's government, especially the seizure of white-owned farms, which has led to the collapse of the agricultural sector, formerly the mainstay of the economy.

The commercialisation and privatisation of parastatals started in the early 1990s but since then only a few companies have been privatised.And when did the Zimbabwe government do much in the way of debt repayment? In fact Zimbabwe has run up large foreign debts. As this 2009 report notes

These included CBZ Bank, Dairibord, the Cotton Company of Zimbabwe, Zimre and Rainbow Tourism Group.

The privatisation of these former parastatals transformed them into very profitable entities that are competing favourably in the market.

Government however still holds 100 percent shareholding in the National Railways of Zimbabwe, Zesa Holdings, Cold Storage Company, Air Zimbabwe and the National Oil Company of Zimbabwe.

Others include the Industrial Development Corporation, TelOne, NetOne, The Zimbabwe Mining Development Corporation, Minerals Marketing Corporation of Zimbabwe and the Zimbabwe National Water Authority.

Efforts to privatise some of these, which continue to be a drain on the fiscus, has not yielded any fruit to date. (Emphasis added.)

The IMF says it was owed $89 million at the end of February 2009. The World Bank says Harare owes it $600 million, and the African Development Bank says it was owed $429 million as of the end of June last year.As economists Peter Draper and Andreas Freytag put it in this article, What future for monetary policy in Zimbabwe?, at VoxEU.org.

Gono said Zimbabwe also owed the Paris Club of sovereign creditors about $1.1 billion.

Mr Mugabe and his Zanu PF party not only destroyed the economy thereby creating hyperinflation, poverty and starvation– they also eradicated a workable [government] administration. The latest manifestation is the cholera crisis, now reportedly affecting 80,000 people and spreading rapidly into neighbouring countries. Critically, all kinds of economic institutions necessary for a country to develop are now lacking.According to the 2008 "Economic Freedom of the World Report", Zimbabwe was one of only three counties in the world to decreased their score by more than one point: Zimbabwe's dropped by −1.93. In fact Zimbabwe once again has the lowest level of economic freedom among the 141 jurisdictions included in the study.

All of this had nothing to do with the IMF or the World Bank. There are many things you may be able to blame these organizations for, but the situation in Zimbabwe isn't one of them. Zimbabwe's terrible, horrifying, economic and social conditions have but one cause, Robert Mugabe. To claim otherwise is totally bizarre, even for "The Standard".

Update: Liberty Scott comments here and Brad Taylor here.

Update 2: The Inquiring Mind inquires here.

Friday, 27 March 2009

Good money drives out bad

This report from the BBC says

Peter Draper and Andreas Freytag point out that dollarisation is not without its dangers, however

Prices in Zimbabwe have begun to fall after years of galloping inflation, according to figures from the state Central Statistical Office (CSO).and

Prices of goods bought in US dollars, Zimbabwe's new official currency, fell by up to 3% in January and February.

They were the first official figures since the country's recent adoption of the US dollar.

The US dollar was adopted by Zimbabwe's government following the inauguration of the unity government between the MDC and President Mugabe's Zanu-PF.and adds

The Zimbabwean dollar has disappeared from the streets since it was dumped as official currency.The move to the US dollar is to be welcomed as it will help with the fight against the hyperinflation which Zimbabwe has suffered from in recent years. Hopefully it also signals that more rational economic policies, in general, will be followed in Zimbabwe from now on. Dollarisation was one of the options that Steve Hanke put forward when writing about How to kill Zimbabwe’s hyperinflation.

Peter Draper and Andreas Freytag point out that dollarisation is not without its dangers, however

The currency board or “dollarisation” option is closely associated with US scholar Steve Hanke (2008). In Zimbabwe’s case, he refers approvingly to the currency board Southern Rhodesia operated in the 1940s. However, the preconditions were very dissimilar to Zimbabwe today. Regardless of Rhodesian governments’ other failings, their administrative capacity, and therefore the credibility of any new institutions, was far more developed, whilst trade and capital markets were far less integrated than today. Mr Mugabe and his Zanu PF party not only destroyed the economy thereby creating hyperinflation, poverty and starvation– they also eradicated a workable administration. The latest manifestation is the cholera crisis, now reportedly affecting 80,000 people and spreading rapidly into neighbouring countries. Critically, all kinds of economic institutions necessary for a country to develop are now lacking.This seems a fair point, its hard to believe that there is much in the way of workable government (or private) institutions left in Zimbabwe. So it will be interesting to see how things progress. Hopefully the new government can rebuild the needed institutions. At least now there is reason for a small amount of hope for Zimbabwe.

Sunday, 1 March 2009

What future for monetary policy in Zimbabwe?

That really is one big question! But Peter Draper and Andreas Freytag ask it in this article, What future for monetary policy in Zimbabwe?, at VoxEU.org.

Draper and Freytag argue that Zimbabwe needs major monetary reform to cure its hyperinflation. That really has to be the understatement of the century so far! They see three options as being on the table – adopting a currency board, the South African Rand, or a crawling peg. Their column argues against a currency board and says that “Randisation” deserves serious consideration – if South Africa will step up to the plate.

Draper and Freytag open by explaining

Draper and Freytag argue that Zimbabwe needs major monetary reform to cure its hyperinflation. That really has to be the understatement of the century so far! They see three options as being on the table – adopting a currency board, the South African Rand, or a crawling peg. Their column argues against a currency board and says that “Randisation” deserves serious consideration – if South Africa will step up to the plate.

Draper and Freytag open by explaining

Zimbabwe is much in the news again with its newly minted unity government. It remains to be seen whether it will cohere and drive a concerted reconstruction process. Zimbabwe’s future monetary policy is of enormous importance, given the country’s infamous inflation rate.First up, what about Dollarisation? Draper and Freytag write

Three monetary reform scenarios are being discussed – an ordinary or crawling peg to a basket of currencies, “Randisation” (adopting the Rand), and a currency board, i.e. a domestic currency with the money base 100% backed by foreign reserves. The latter two would entail Zimbabwe surrendering monetary policy sovereignty – an issue attracting considerable controversy.

The currency board or “dollarisation” option is closely associated with US scholar Steve Hanke (2008). In Zimbabwe’s case, he refers approvingly to the currency board Southern Rhodesia operated in the 1940s. However, the preconditions were very dissimilar to Zimbabwe today. Regardless of Rhodesian governments’ other failings, their administrative capacity, and therefore the credibility of any new institutions, was far more developed, whilst trade and capital markets were far less integrated than today. Mr Mugabe and his Zanu PF party not only destroyed the economy thereby creating hyperinflation, poverty and starvation– they also eradicated a workable administration. The latest manifestation is the cholera crisis, now reportedly affecting 80,000 people and spreading rapidly into neighbouring countries. Critically, all kinds of economic institutions necessary for a country to develop are now lacking.Seems a fair point, its hard to believe that there is much in the way of workable government (or private) institutions left in Zimbabwe. What this means is that a currency board or dollarisation may be difficult to implement. For both regimes to work a number of institutional pre-conditions, particularly fiscal stability, openness to trade and capital flows, and market flexibility are needed. And they just aren't there. An additional pre-condition is trust in markets and in state agencies. If the central bank is not to be trusted, and who would trust it given its recent history, why should the ordinary Zimbabwean citizen trust a currency board (unless it is located out of the country)? Draper and Freytag go on

Furthermore, a currency board would require the Zimbabwean government to possess sufficient foreign exchange reserves to finance the monetary base. In January 2008, the date of the latest available data, the Zimbabwean central bank’s foreign assets accounted for approximately 0.1% of the monetary base. Clearly reserves are too small to finance the monetary base in a currency board without recourse to massive foreign capital injections from the donor community. But those are only likely to be forthcoming once Mr Mugabe and his securocrats have decisively left the scene – a prospect we find rather bullish under current political circumstances.One would hope this last point is right. Draper and Freytag continue

Over time, a currency board system requires the ability to earn the necessary money growth on global markets. Zimbabwe does not have the production structure (even before the meltdown) to generate the exports required nor the human resource capacity to sustain such a high rate of exchange (i.e. the US dollar) through rapid productivity growth, and the high rate of exchange would encourage imports (no bad thing if you have the foreign exchange, which Zimbabwe won’t) whilst discouraging exports. Hence Mr Hanke’s advice could penalise Zimbabwe’s recovery for a long time.Next Draper and Freytag look at Randisation.

Finally, it is not obvious that the Zimbabwe Reserve Bank should lose its competencies, as the currency board solution would require. Those advocating this path argue that the Zimbabwe Reserve Bank has become so politicised (correct) that it is beyond redemption (debatable). However, the same argument applies to other state institutions used as Zanu PF’s piggy bank. The situation is much worse than it was in Estonia and Lithuania when they adopted currency boards in 1992 and 1994, respectively.

Overall, a currency board may be the least attractive alternative

What about adopting the Rand, as recently suggested by South African President Mr Motlanthe, and rejected by Zimbabwe’s new Finance Minister from the Movement for Democratic Change, Mr Biti? For each South African citizen, 1000 Rands are circulating. Adopting the same ratio in Zimbabwe would require 11 billion Rands. Currently the total cash circulation in South Africa is about 73 billion Rand. An increase of 11 billion Rand would add 15% – a substantial increase.The third possible alternative is a simple (or crawling) peg to a basket of currencies including the rand.

This solution requires dismantling the central bank’s money-issuing function. Politically, this may be easier than having a crippled central bank. Randisation would more politically insulated than a currency board, as money issuance would require South African approval. Politically, this would be very tricky. On the other hand, Zimbabwe would gain the reputation of the Rand without requiring the backup of foreign reserves.

However, South Africa’s partners in the Common Monetary Area (Namibia, Lesotho, and Swaziland) may not support this path. Moreover, unless South Africa imposes stringent conditionalities on the reconstruction loans it undoubtedly will extend to Zimbabwe, the latter will be enormously tempted – especially in the likely absence of major donor funding – to deviate from the CMA’s strictures using fiscal policy, thereby destabilising regional currency arrangements.

This scenario, coupled with a Zimbabwe Reserve Bank and Finance Ministry with new leadership, seems possible and politically most feasible. It requires less ambitious policy reforms in other policy areas and does not require huge foreign reserves to sustain it. The question is whether Zimbabwean institutions would have the confidence in their people and foreign investors to sustain the peg. Like the other two scenarios, it is unthinkable without a ban on government borrowing at the central bank. This condition must be highlighted, as it is the sine qua non of any sensible monetary reform.Draper and Freytag conclude

If the government can keep away from the money press, both the peg and the circulation of the Rand are sustainable. Overall, it is not clear to us which is more desirable. On political grounds the peg is more feasible, but if the economy is to be brought back on track, inflation has to be reduced quickly and Randisation proffers that possibility.

- Hanke, Steve H. (2008), How to Kill Zimbabwe’s Hyperinflation, Global Dialogue, Braamfontein, August, pp. 23-25; 35-36.

Tuesday, 3 February 2009

You know you have hyperinflation when ......

.... you can cut 12 zeros off your banknotes.

This report from the BBC says that Zimbabwe is revaluing its dollar again, removing twelve zeros from the currency with immediate effect. Just last year, the central bank was forced to take 10 zeros from the local unit in an effort to make the currency more manageable, but the zeros returned within a few months. And the 12 just removed will also return within a few months.

This report from the BBC says that Zimbabwe is revaluing its dollar again, removing twelve zeros from the currency with immediate effect. Just last year, the central bank was forced to take 10 zeros from the local unit in an effort to make the currency more manageable, but the zeros returned within a few months. And the 12 just removed will also return within a few months.

Monday, 26 January 2009

Interview with the central banker of Zimbabwe

Is this strange ... or what:

(HT: Marginal Revolution.)

I've been condemned by traditional economists who said that printing money is responsible for inflation. Out of the necessity to exist, to ensure my people survive, I had to find myself printing money. I found myself doing extraordinary things that aren't in the textbooks. Then the IMF asked the U.S. to please print money. I began to see the whole world now in a mode of practicing what they have been saying I should not. I decided that God had been on my side and had come to vindicate me.I really don't know if God is on the side of hyperinflation. The whole interview is here.

(HT: Marginal Revolution.)

Sunday, 18 January 2009

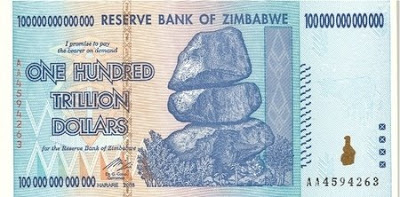

Hyperinflation and then some

According to this BBC report, Zimbabwe is introducing a Z$100 trillion note, which is currently worth about US$30 or £20.

Just for the record, according to Steve H. Hanke at the Cato Institute Zimbabwe's inflation rate is 89,700,000,000,000,000,000,000% This is as at 14/11/08. There is an interesting note on the web page for Zimbabwe's inflation rate,

Just for the record, according to Steve H. Hanke at the Cato Institute Zimbabwe's inflation rate is 89,700,000,000,000,000,000,000% This is as at 14/11/08. There is an interesting note on the web page for Zimbabwe's inflation rate,

Since mid-November 2008, the weekly update of the HHIZ has been put on hold. The market-based price data from Zimbabwe have deteriorated and, at present, cannot be used to update the HHIZ. HHIZ updates will be resumed as soon as the quality of the data reaches a satisfactory level.So we can't even estimate the inflation rate in Zimbabwe. We just know its got to be a lot more than what ever that number above is!

Wednesday, 19 November 2008

Zimbabwe's inflation rate - update

According to Steve H. Hanke's new Hyperinflation Index (HHIZ) at the Cato Institute, Zimbabwe's annual inflation is 89.7 sextillion percent!

The index was set at 1.00 on the 5th of January 2007. As at the 14th of November 2008 the index is at 853,000,000,000,000,000,000,000 which gives an annual inflation rate of 89,700,000,000,000,000,000,000%.

Here is an article, Zimbabwe hyperinflation 'will set world record within six weeks', from the Telegraph in the UK on the hyperinflation in Zimbabwe and what it means:

The index was set at 1.00 on the 5th of January 2007. As at the 14th of November 2008 the index is at 853,000,000,000,000,000,000,000 which gives an annual inflation rate of 89,700,000,000,000,000,000,000%.

Here is an article, Zimbabwe hyperinflation 'will set world record within six weeks', from the Telegraph in the UK on the hyperinflation in Zimbabwe and what it means:

There comes a point, though, where the inflation rate makes little practical difference.Reverse Gresham's Law: Good money drives out bad.

"The economy just stops functioning or slows down very much," said Prof Hanke. "A lot of barter takes place. Money is not used as much or if it is, it's all foreign exchange." Supermarkets in Harare are accepting only US dollars and South African rands, leaving those Zimbabweans without access to foreign currency in dire straits.

Friday, 31 October 2008

Zimbabwe's inflation rate

According to Steve H. Hanke's new Hyperinflation Index (HHIZ) at the Cato Institute, Zimbabwe's annual inflation is 10.2 quadrillion percent!

The index was set at 1.00 on the 5th of January 2007. As at the 24th October 2008 the index is at 48,500,000,000,000,000.00 which gives an annual inflation rate of 10,200,000,000,000,000%.

The index was set at 1.00 on the 5th of January 2007. As at the 24th October 2008 the index is at 48,500,000,000,000,000.00 which gives an annual inflation rate of 10,200,000,000,000,000%.

Friday, 3 October 2008

Inflation record?

Absent current official money supply and inflation data, it is difficult to quantify the depth and breadth of the still-growing economic crisis in Zimbabwe. To overcome this problem, Steve H. Hanke, Professor of Applied Economics at The Johns Hopkins University and Senior Fellow at the Cato Institute, has developed the Hanke Hyperinflation Index for Zimbabwe (HHIZ). This new metric is derived from market-based price data and is available here for the January 2007 to present period. The HHIZ will be updated weekly.

As of 26 September 2008, Zimbabwe's annual inflation rate was 531 billion percent.

As of 26 September 2008, Zimbabwe's annual inflation rate was 531 billion percent.

Friday, 15 August 2008

Poverty and economy in Mugabe's Zimbabwe

This short audio from the Cato Institute discuss "Poverty and Economy in Mugabe's Zimbabwe". This Cato Daily Podcast features Rejoice Ngwenya, a Zimbabwean writer and head of the Zimbabwean Coalition for Market & Liberal Solutions.

Wednesday, 6 August 2008

Now not to deal with inflation

This report, by Angus Shaw of the Associated Press, from the SFGate tells us that

Zimbabwe announced Wednesday that it is knocking 10 zeros off its hyper-inflated currency - a move that turns 10 billion dollars into one.The report goes on to say

President Robert Mugabe threatened a state of emergency if businesses profiteer from the country's economic crisis, a move that could give him even more sweeping powers to punish opponents in the event that political power-sharing talks fail.The report also notes why the zero have been dropped.

"Entrepreneurs across the board, don't drive us further," Mugabe warned in a nationally televised address after the currency announcement. "If you drive us even more, we will impose emergency measures. ... They can be tough rules."

Gono, the central bank governor, acted because the high rate of inflation is hampering the country's computer systems. Computers, electronic calculators and automated teller machines at Zimbabwe's banks cannot handle basic transactions in billions and trillions of dollars.Will this reduce inflation? No, as it does not deal with the real cause of the problem, but only a symptom. As the report says

Inflation, the highest in the world, is officially running at 2.2 million percent in Zimbabwe, but independent economists say it is closer to 12.5 million percent.

Economist John Robertson said the new bills will soon be worthless, because the inflation rate continues to skyrocket. What costs $1 at the beginning of the month can cost $20 by month's end, he said.This report from the Washington Post tells us

"This is attending only to the symptoms of the problem. The real problem is the scarcity of everything driving up the prices. ... The government has not only caused the scarcities but damaged our ability to fix the problem."

At the root, he said, is the damage to the farming sector, along with government raids on the state pension fund and foreign currency bank accounts of businesses.

Zimbabwe's money shortages, inflation and chronic shortages of food, gasoline, medicine and most basic goods have brought many businesses in Harare to a standstill. Smaller shops and at least four main restaurants have shut down.No one should be surprised that this is happening. With the Zimbabwe dollar worthless, it is sensible for people to move to another median of exchange. The new notes will do nothing to change this. It is impossible to believe that people will assume that the government will stop printing money money just because it issues new notes and coins.

State media reported Saturday that nightclubs were canceling music shows because audiences dried up after a 2,000 percent increase in prices for beer and soft drinks in the past week. Several bars and clubs were openly accepting U.S. dollars, even though that is against the law

Friday, 1 August 2008

How inflation robs Zimbabwe

This short audio from the Cato Institute discuss "How Inflation Robs Zimbabwe". This Cato Daily Podcast features Rejoice Ngwenya, a Zimbabwean writer and head of the Zimbabwean Coalition for Market & Liberal Solutions.

A related audio and video is "Escaping Poverty in Sub-Saharan Africa". This features Rejoice Ngwenya and Marian Tupy of the Cato Institute.

A related audio and video is "Escaping Poverty in Sub-Saharan Africa". This features Rejoice Ngwenya and Marian Tupy of the Cato Institute.

The southern African countries of Botswana and Zimbabwe are neighbors. Botswana is peaceful, stable, and increasingly prosperous. Zimbabwe, in contrast, is beset by political and economic crises. Their diverging fortunes are partly explained by their government’s attitudes to economic freedom: Botswana is one of Africa’s economically freest states, and Zimbabwe is among Africa’s least free countries. Rejoice Ngwenya and Cato’s Africa analyst Marian Tupy to discuss Zimbabwe’s meltdown, Botswana’s ascent, and lessons for the rest of Africa.

Monday, 21 July 2008

You know you have inflation when .....

From CNN.com comes the news that Zimbabwe introduces $100 billion banknotes.

The article states

The article states

(HT: Carpe Diem)

Zimbabwe started issuing large bank notes in December, starting with denominations of $250,000.This is because Zimbabwe has an

In January, the government issued bills in denominations of $1 million, $5 million, and $10 million -- and in May, it issued bills from $25 million and $50 million up to $25 billion and $50 billion.

... official inflation rate now at 2.2 million percent.The article also says

As high as they are, though, the bills still aren't enough to buy a loaf of bread. They can buy only four oranges.The article goes on to explain that Gideon Gono, governor of the Reserve Bank of Zimbabwe, has said

The new note is equal to just one U.S. dollar.

"The RBZ has noted with concern the unjustifiable and incessant general increases in prices of goods and services. It is therefore appealing to the business community to follow ethical business practices as well as take an interest in the plight of the general public,"Why doesn't he "take an interest in the plight of the general public" and stop printing money?! Following "ethical business practices" is not the answer to hyper-inflation, stopping the printing of money is.

(HT: Carpe Diem)

Tuesday, 1 April 2008

Mapping the election conditions in Zimbabwe

Here is an interesting map showing the election conditions in Zimbabwe. View it and consider whether elections held in this context can ever be considered 'free and fair'.

Saturday, 29 March 2008

Inflation Zimbabwe style (updated)

Shashank Bengali reports, via his blog, Somewhere in Africa, on inflation in Zimbabwe. He writes

After a catastrophic few years that have seen the economy crumble and inflation soar to 200,000 percent, Mugabe's most powerful political weapon – fear – appears to be eroding. To understand what 200,000 percent inflation means, a journalist friend I was traveling with, N., said that on Friday, he had lunch at a hotel in Harare , where a local beer cost 2 million Zimbabwean dollars (less than $1). He passed by the hotel after work the same day and the same beer was going for more than 4 million.Update: Ken Rogoff talks about Zimbabwe's hyperinflation on National Public Radio, see Zimbabwe's Hyperinflation Poses Unique Challenges.

Thursday, 31 January 2008

Voting with your feet.

An article on the website CFR.org reports that

There is little point in trying to bring about change by voting in an election in Zimbabwe, so people vote with their feet ... repeatedly,

Some sixty thousand Zimbabweans were deported from Botswana in 2006, and over 23,000 were deported between April and November 2007. South Africa deported over 150,000 Zimbabweans in the first nine months of 2007, according to Refugees International.The report goes on to point out that

... the primary reason Zimbabweans leave their country: the need for money.These people are economic refugees who are simply fleeing Zimbabwe's economic collapse. The huge number of such people just goes to show how bad the situation in Zimbabwe has become.

There is little point in trying to bring about change by voting in an election in Zimbabwe, so people vote with their feet ... repeatedly,

"These repatriations are more or less a vicious cycle," says Moses M. Gaealafswe, Botswana's chief immigration officer told CFR.org. "You arrest them today, you repatriate them tomorrow, next week they are here."

Subscribe to:

Posts (Atom)